The entire world awaits the results of the U.S. Presidential Election. Unprecedented angst and uncertainty. And risk. As of Nov 5th, SPX was pricing in a 68% chance for a 33 point move by Nov 9th, the day after the election. That’s a ~$66 expected move in either direction–about $2162 to $2030. And that’s not even counting the tail risk: the entire shock-and-awe one day move could be ~$132 in either direction–about $2228 to $1964. Whoa.

Going into Brexit, we had no such risk priced in, which is why we have now. Many were caught off-sides back in June. Until recently, Clinton was priced into the market, meaning, the ‘certainty’ of her winning kept the indices up and the VIX down. But all that changed, and in a hurry. You have no doubt seen mention and charts referencing outsized inflows of SPX put hedging last week. Well here’s the result: in one week, from the Friday before Halloween to Friday the 4th, the S&P 500 had fallen only 2.6% while the $VIX gained 60%. Whoa again.

So $VIX is showing signs of being overbought and $SPX of being oversold, so the question of whether we bounce Monday is a logical one. I’m just not sure we can use logic in front of this election.

SPX is Cracking but Not Breaking

Cracks started in September. I posted my thesis Sept 12 (really Sept 9th) for ~$2000 SPX by election (when it was still $2169). I expected for it to stair step it’s way down as interest rates rose and Trump gained ground in the polls, although still expecting a Clinton win, as the market was pricing in the latter not the former.

I posted Oct 4th, I was convicted with my intermediate-term bearish SPY short at $214.60 with the thesis that the market had not priced in an expected December rate hike and the interest-rate sensitive S&P stocks had not priced this in either, although clearly $XLP $XLU $TLT were. I smelled risk off behavior forming when I posted Oct 13th how unusual it was that $VIX was above $VXV. On Oct 19th, I posted a macro chart of corporate tax receipts diverging from SPY from @epomboy and noted how often the peak in the stock market times with a yield curve inversion + accompanying downturn in corporate profits. I was watching my Stock-Bond-VIX Ratio like a hawk. It has always foretold Big Moves; it was telegraphing but had not yet triggered.

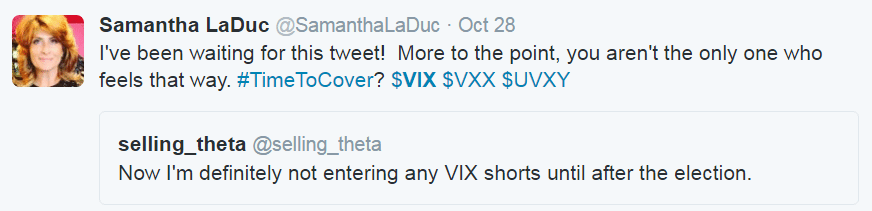

But then it all came together October 28 when we had that Friday afternoon backdraft in SPY on the FBI/Clinton news and @selling_theta, who is a master at shorting VIX, wrote:

Now, I want to go backward before I go forward just to show how much patience is involved in this game. These are my top five themes I kept in the back of my mind, posted often and traded around actively the past two months. Some have played out; others are just starting.

We are on support but there are big cracks.

- Yield Thesis: I believed the Fed didn’t have to ‘raise’ rates or intonate as such for the market to react. A rising $USD is de facto tightening and my chart analysis said $USD was going to rise, $TNX was going to rise, and with that, $GLD $FXY, $TLT and $SPY would be affected to the downside. They were.

- Japan as The Tell: I believed and wrote Sept 21st that the 10 yr yield on $JGB was just beneath the zero rate for the last time. With the BOJ seting the new cap on benchmark rates at zero, my bet was that they would defend 100

$USD/YEN and that the FED would help. Translation: I watched for the trigger to short the Yen and go long the $USD using $FXY and $GLD $GDX as my proxies short. That worked. - Playing the STUB bubble: Staples, telecom, utilities and bonds had approached a 3 Sigma Event so I figured this was another Tell that bonds were done going up. My $TLT chart read confirmed it. But it was most profitable shorting individual stocks within

$XLU XLP complex. With that, it wasn’t until Oct 3rd I noticed the big weekly gaps down in many of the REIT charts. It was the real Tell that rates were about to rise. And since then: $IYR is down -14% from it’s Aug high, which honestly disguises much of the individual bloodletting under the surface, with $TNX up +30% from July lows. Outliers revert with velocity. - SPX not budging: Sideways chop–big picture or small–has defined trading for the past three years in the S&P. Most recently, on Sept 9th, we had a change in investor sentiment worth noting when $SPX gapped down (at $2169 leaving an island reversal bearish signal). That’s when I posted Sept 12th that lower was coming and wrote,

“Outliers w Velocity Revert: Past 8 wks $DIA traded tightest range in 100yrs. $VIX had fallen 68%. Rates <2% 2nd longest stretch in history.”

Well, we know rates began their move but not so much indexes and volatility. Still I have the advantage of studying intermarket analysis and given the bad breadth, the divergences were obvious inspite of, or despite, an elevated $SPX, as posted Oct 28th.

“And last two times we were here,

$SPX was 200-300 pts lower…”Clearly, we are not there yet. I just happen to believe we will be.

- VIX as dynamite: Suppressed volatility as noted Oct 2nd required both patience and vigilance not to bet against. It wasn’t until Oct 28th that my Put-Call Ratio moved. After two months of not moving. Going short the market and long volatility, regardless of whether VIX was in backwardation/contango, was my call. And that’s not easy when everyone is shorting volatility, but that’s exactly when it’s most dangerous to be shorting volatility, as Jesse Felder hypothsizes back in August. Even though I didn’t see an pending VIX explosion in my chart prior Oct 28, I couldn’t keep Chris Cole’s thesis out of my head:

“If markets experienced any of these historic crashes at current levels of short convexity the entire $2bn+ short volatility ETP complex could potentially be wiped out overnight.”

VIX On The Move

And that brings me back full circle to why this one innocuous tweet, moved me. I wanted to be ready, just in case.

And so it worked. The S&P 500 only fell 2.6% in the past week but VIX gained 60%. My point is one I posted back in Aug: The Big VIX Short trade will take more than a few days to unwind.

With that, oversold conditions are numerous right now, but they haven’t triggered intermediate-term buy signals either. So with Volatility bid up in ALL future months, I’m betting that Volatility, and a $SPY pullback, is not going away post election. Especially if Trump wins.

Friendly Note: If you wish to receive future Free Blog Fish Stories, it’s easy to subscribe.

Thanks for reading and Happy Trading,

Samantha LaDuc