At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. My annotated Charts are meant to do most of the talking and illustrate my Thesis, Trigger, Time Frames, Trade Set-ups and Option Tactics. When applicable, I note Unusual Option Activity (UOA) and Deal Flow. I also keep a Tally and follow a Trade Plan, both of which are made available to members. No proprietary indicators are used, just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in. Don’t hesitate to contact me with questions or comments: [email protected].

The LaDucTrading Gone Fishing Newsletter is divided into basically three parts:

- Reflections and Inflections

- Events This Week and How I’m Trading It

- Macro Considerations

Reflections and Inflections

Trump is on vacation, as is Congress, so maybe now volatility will rise (she writes half jokingly). It’s not funny that the 10-day realized vol of SPX is at 2.32 — the lowest since May 7, 1965! Here’s a novel idea: maybe it won’t be the absence of political figures but more the absence of internal breadth that triggers a volatility event. Also note how the divergence between the % of NYSE and NASDAQ stocks at 52 week low while indices are at 52 week high has resolved in the past:

Via @historysquared pic.twitter.com/f4RR607kQm

— Lawrence McDonald (@Convertbond) August 6, 2017

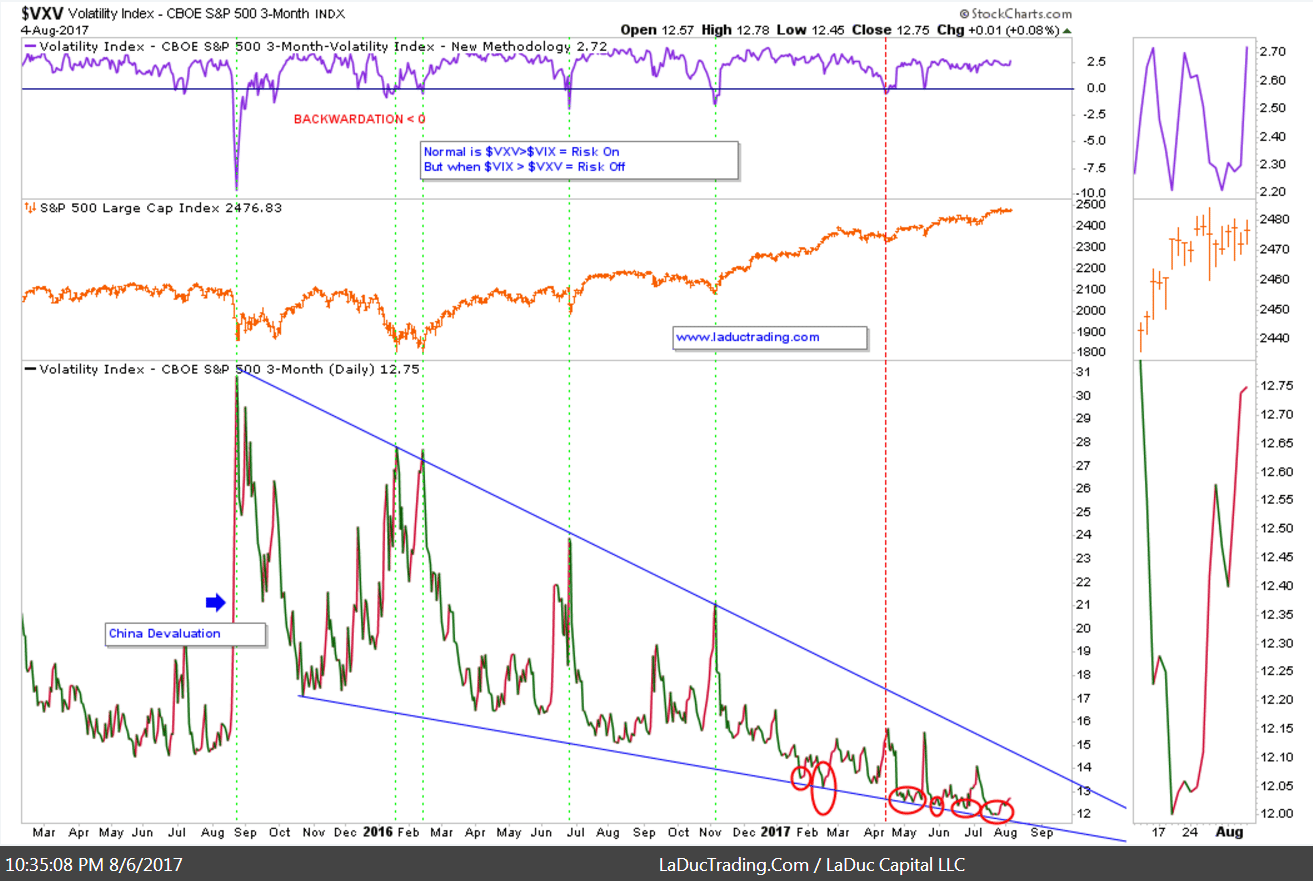

And here’s my volatility of volatility chart, updated, that is just teasing and snaking it’s way into an ‘Apex of Alarm’:

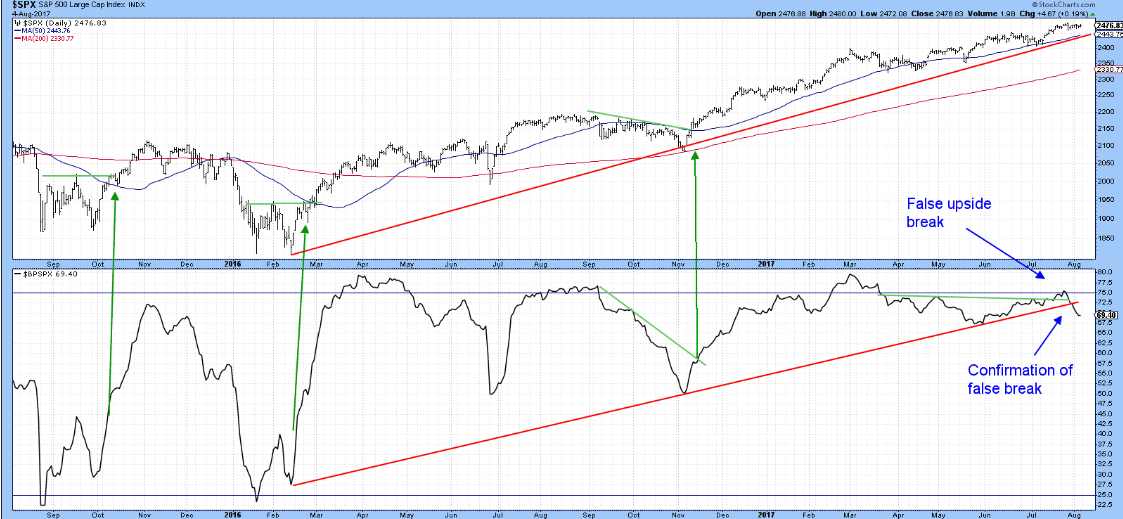

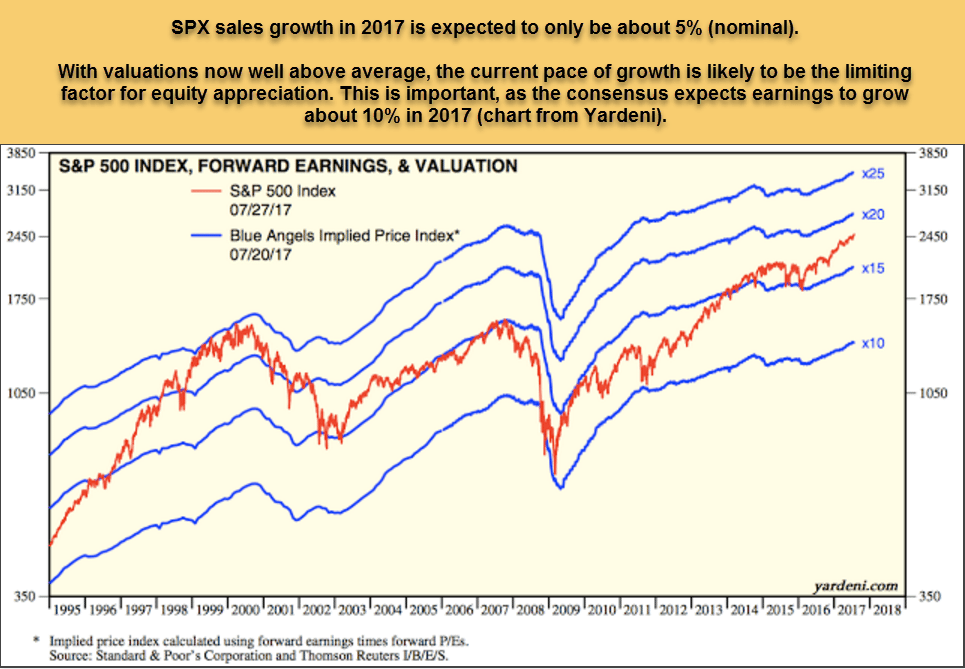

And while Q2 Earnings Seasons were above their historical averages, forward 12-month EPS guidance has fallen. Kind of like this bullish percentile ratio of SPX:

So we had great earnings, especially as compared to 2Q 2016 which wasn’t hard given the earnings recession back then, but this time, these great earnings more often than not were sold off. Poor reactions to strong earnings, combined with a loss of internal strength, are clear divergences. This feels a lot like money looking for an excuse to lighten up/take profits into a seasonal weak period. Topping is a process and markets weaken before they correct. As far as I’m concerned, it’s a sign to be concerned when stocks stop going up on good news.

Shares of companies that beat earnings forecasts have failed to meaningfully rally for the first time in 17 years. https://t.co/H7ues7O8SB

— Lisa Abramowicz (@lisaabramowicz1) August 2, 2017

Doesn’t help that year-to-date, US stocks have suffered almost $100 billion of outflows, according to BofA. Valuations are expensive across most assets classes, save cash and gold. But Spec long positioning in gold futures hasn’t been this low since Jan 2016 and gold and silver COT reports show another big percentage increase in commercial shorts from historically low levels. Are we approaching an inflection point year-end?

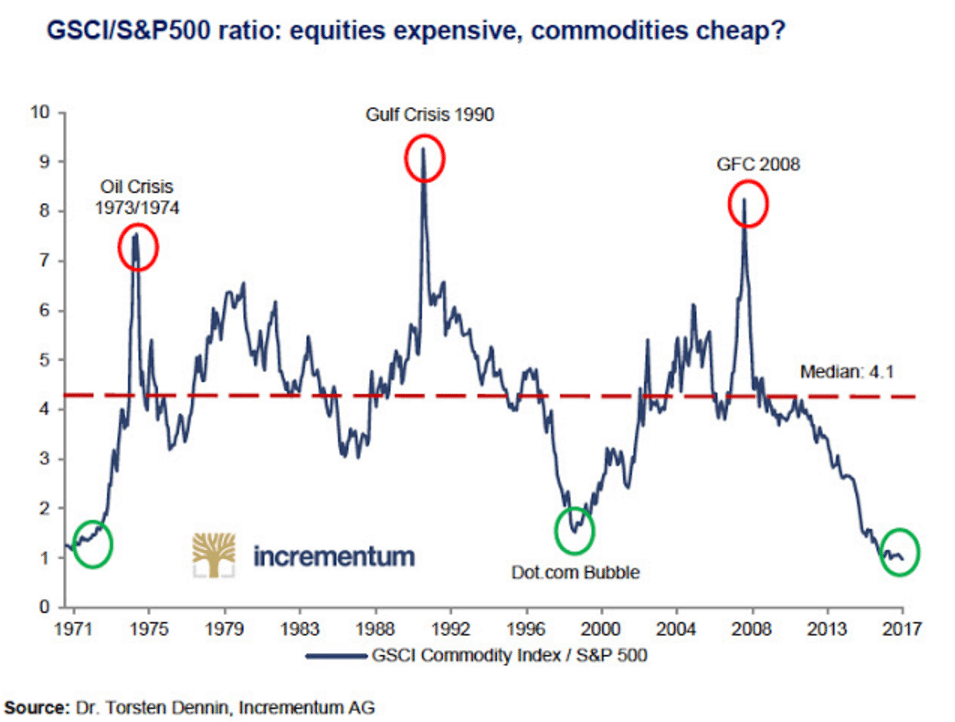

So while we are waiting for the Commodity Super Cycle to kick in–across precious metals, industrial metals, oil, food/ags, wages et al–we have to respect that the SPX has risen about as far as it can go without actual growth or actual fiscal policy. And neither looks forthcoming.

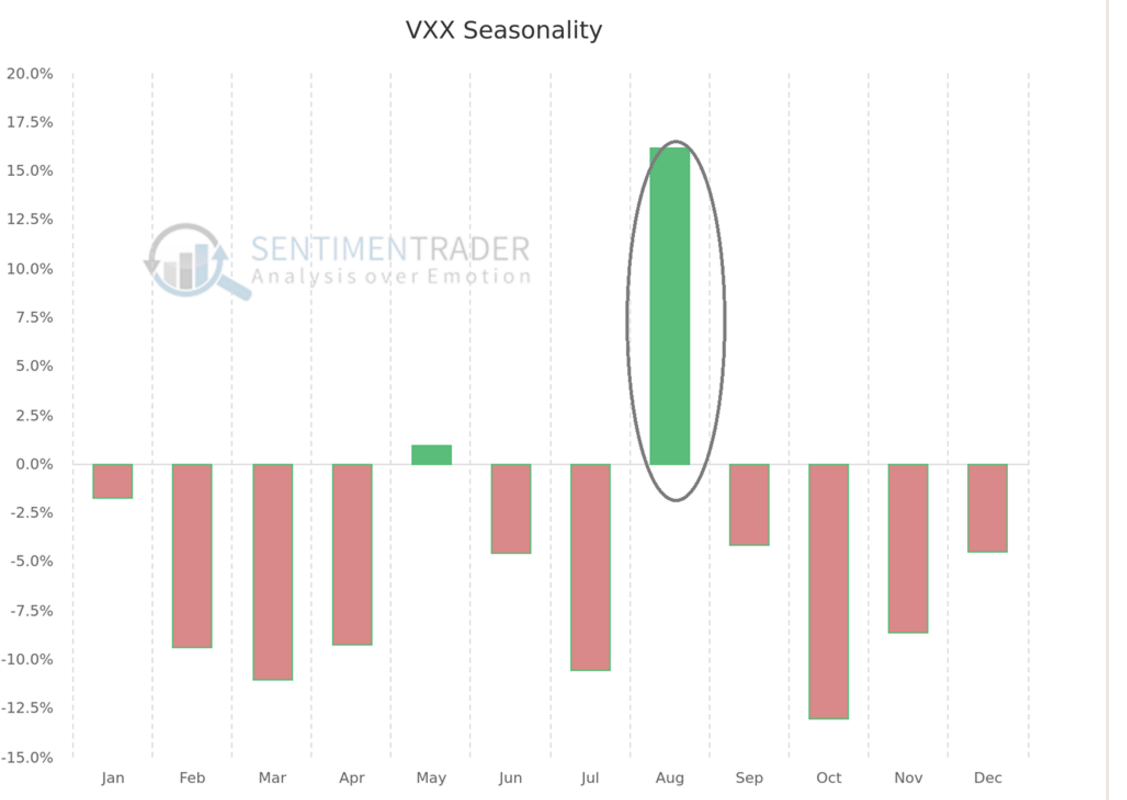

And let’s keep in mind the Most Important Chart for August:

And let’s keep in mind the Most Important Chart for August:

Events This Week and How I’m Trading It

Economic Reports

Monday is a Full Moon. Yup, I just entered that under ‘Economic Reports’. Also Monday, there is Fed Talk from Bullard and Kashari. Watch the oversold USD as any hawkish tones can extend the USD bounce and with it bond/gold pullbacks. Next up: another two-day OPEC conference in Abu Dhabi to discuss production cuts, which should present another opportunity to short oil. China data hits this week as well as another 40+ EPS reports, which include several tradable China plays we are stalking. The only major release is US inflation on Friday (which has missed four months in a row now) and This Is The Tell on whether FED has grounds to justify it’s main decision to raise rates based on ‘inflation mandate of 2%”. Expect a reaction, either way, in the reflation trade. And of course, with Russia-gate and Special Prosecutor Mueller impaneling a Grand Jury, any news on this front may be market-moving.

Monday: Germany Industrial Production, Eurozone Sentix Economic Index, US LMCI, Japan Bank Lending, Current Account, China Trade Balance

Tuesday: Germany France Trade Balance, US JOLTS, API Crude Inventories, S Korea Unemployment Rate, China CPI, PPI, Australia Home Loans

Wednesday: Italy Industrial Production, US Productivity, Unit Labor Costs, Wholesale Inventories, DOE Crude Inventories, Japan Core Machinery Orders, PPI

Thursday: France Industrial Production, Italy Trade Balance, UK Industrial Production, Trade Balance, Construction Output, US Jobless Claims, PPI, China New Loans

Friday: Germany, France, Spain, Italy, US CPI

Earnings Reports

UPCOMING EARNINGS

Mon – $TWLO $LC

Tue – $DIS $VRX $PCLN $HTZ $W

Wed – $SINA $WB

Thu – $SNAP $M $NVDA

Fri – $JCPhttps://t.co/hRIpgmAmjH— Stocktwits (@Stocktwits) August 6, 2017

Member Trading Video

Member Trading Video will be sent separately with trading notes to accompany it.

And this Mid-Week “Closing US Dollar Swing Short” Video still applies!

Macro Considerations

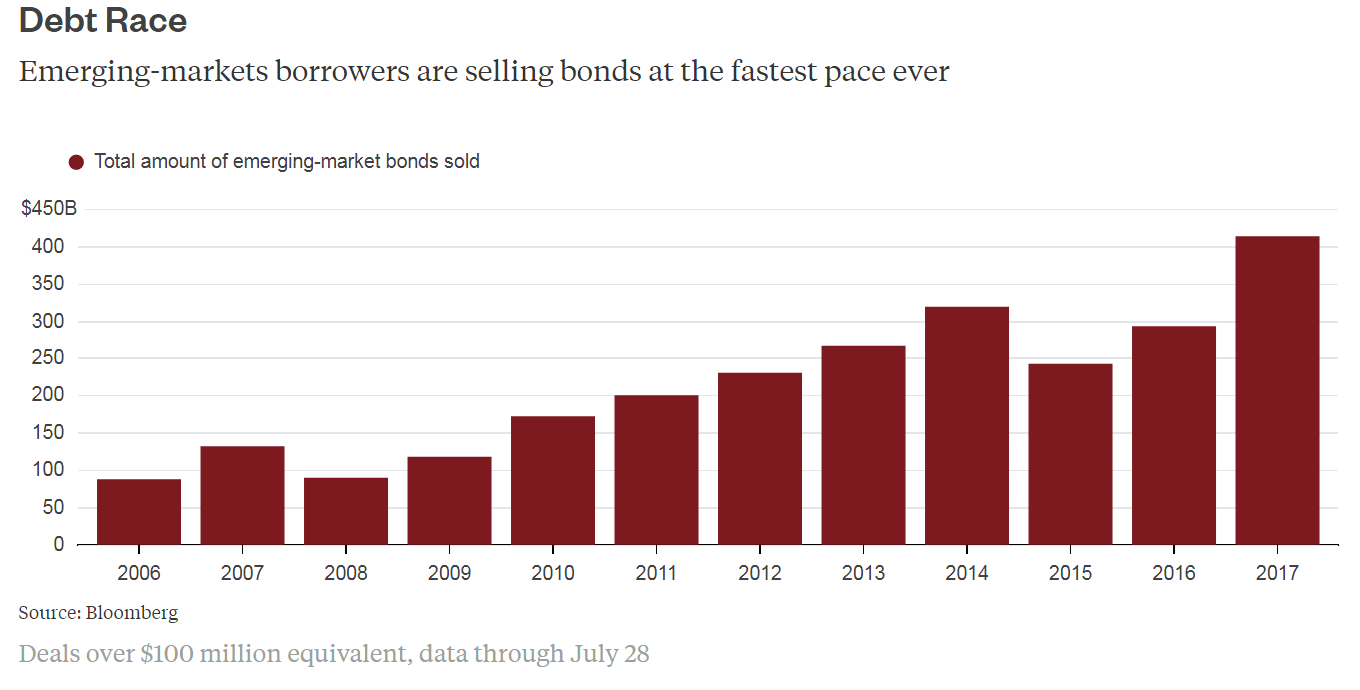

The EMB Debt Race

Emerging Market borrowers are selling bonds at fastest pace ever. Tide…swimming naked… means careful EEM EWG longs!

Venezuela ‘Butterfly Wings’

Venezuela bonds account for more than 2% of EMB, the biggest emerging-markets debt ETF. If/When Venezuelan debt of $5B defaults, will it have been priced in?

"The credit quality of bonds today is more fragile relative to the pre-crisis peak": $EMB $EEM $ EWGhttps://t.co/3S3AXJOhal

— Samantha LaDuc (@SamanthaLaDuc) August 4, 2017

Who’s Buying This JNK?

$JNK is not worth the small added returns for risky bonds when the next default cycle will occur. Tide…swimming naked. #AirPocketStocks https://t.co/pTcrW2hHYj

— Samantha LaDuc (@SamanthaLaDuc) August 4, 2017

Are Euro Junk bonds also at all time lows. Wolf makes the case that when there’s “no apparent difference anymore between euro junk bonds and US Treasuries, then all kinds of bad economic decisions are going to be made and capital is going to get misallocated.” And with that, a repricing in currency is not far behind…USD EUR

The 2y US/German rate spread suggests that Euro should be trading at 1.05 Dollar. pic.twitter.com/2rXMgyIc8J

— Holger Zschaepitz (@Schuldensuehner) July 31, 2017

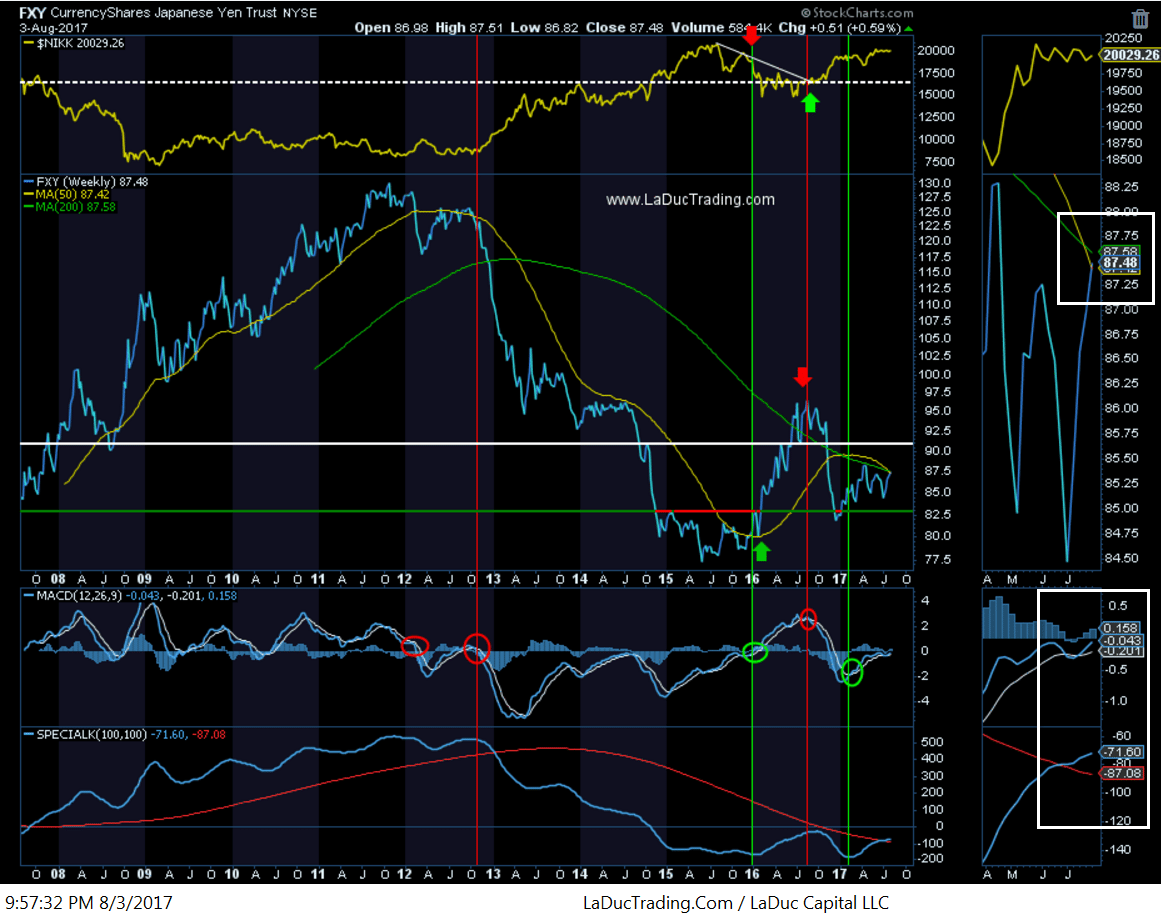

Yen at Inflection

Funds have turned extremely bearish on Yen, holding one of the biggest net shorts in history. However, the price is not making new lows. pic.twitter.com/ByJL7LwIkX

— Tiho Brkan (@TihoBrkan) July 30, 2017

Here’s my chart of FXY which shows it right up against strong resistance in the $87.50 area, which becomes support if/when it climbs over. Why does this matter? A failed devaluation of the Yen will show a no-confidence vote in BOJ/Abe and likely result in NIKK and SPX dropping, and with that GLD and TLT spiking, following the YEN higher. The inverse is also true so it will pay to pay attention!

Feedback and Referrals

I value your feedback. Let me know how I can help!

I value referrals. Let others know I am here to help!

So You Know

You can pop in for a morning or afternoon of LIVE Trading Room analysis and interaction. Or join for a whole day! You get real-time and direct access to my analysis on trade set ups of interest to you.

August Special

For the month of August, I am offering 50% off my LIVE Trading Room, Gone Fishing Newsletter included at $150/mo value of course.

Just enter 1STMO50OFF